In 2021, home prices soared, and the trend is expected to continue in 2022. In January of this year, the average cost of a home purchased in the 11-county area was 375,000 dollars. This price is 23 percent more than the median price in January. It was 0.5 percent down from the previous month’s median price.

A dearth of available dwellings is also a contributing factor. Poor mortgage rates and low inventory defined 2021, creating a perfect combination that will keep pushing housing prices upward in 2022. While costs continue to grow, inventories cannot keep up.

Real Estate Inventory Doesn’t Match the Supply

Overall, the housing market in Metro Atlanta remains competitive, albeit not as aggressively, but that was a few months ago. The supply in metro Atlanta reached a historically low 1.8 months a year ago, and it has continued to fall. As Of May 2021, inventories had only covered one month’s supply, and this fell to 0.9 months in January 2022, which is a new low for this area.

The Atlanta real estate market, is causing quite a stir among industry professionals. It’s easy to see why Georgia’s state capital is one of the strongest markets in 2022, with its strong job growth, rising population, and affordable housing.

How can Real Estate Investors Find Homes to Invest In?

When an investor is working in a competitive market, they need to get creative to find properties. Consequently, it isn’t smart to simply join the bidding wars on homes that have been listed on MLS. However, there are options.

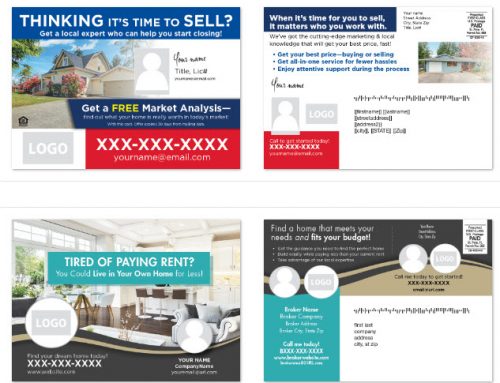

For example, direct mail campaigns are effective in contacting people who are thinking about selling but haven’t taken the time to get their house listed for sale. Obviously, these will be prime targets to purchase homes without competing with all the other investors in the Atlanta Metro real estate market.

Atlanta’s fast-growing market

So, what’s going on in Atlanta’s much-heralded real estate market? And as a real estate professional, how can you take advantage of these trends? Continue reading to learn more.

Price Increases Are Outpacing the National Average

According to experts, Atlanta home prices and existing home sales are expected to climb faster than the overall national average in 2022. Atlanta’s costs are expected to rise at a rate of 3.5 percent, far higher than the national average of 2.9 percent.

Furthermore, real estate sales growth in Atlanta is expected to expand by 10% year over year, compared with the national average of only 6.6 percent.

If real estate prices are so high in Atlanta Metro, can you still get a bargain?

Real estate investors can still find property without paying top dollar. The right targeted mailing list will let you communicate with homeowners who probably haven’t kept up on maintenance or updated their homes. Consequently, they won’t be expecting the high prices.

Some of these mailing lists include: Seniors with 15+ year Ownership and Homeowners with Low Economic Stability Indicators.

Real estate investors should consider the following areas:

- Atlanta City

- Fulton County

- Roswell

- Sandy Springs

Home values in these localities have increased by 28.6% within the last year. Subsequently, over the next 12 months, they’re predicted to grow another 23.3 percent.

Sales growth in Atlanta is projected to increase by 10% year over year, compared to the much anticipated national average i.e. 6.6%.

Do you want to have a look at the Atlanta market for yourself? The heat map & estimated value features might help you locate more hotspots. This allows you to select the best Atlanta possibilities so you can profit from this top market in 2022.

According to the Thriving Renters ‘ Market, renter-occupied houses in Atlanta account for roughly half of all occupied residential units in the metro region. This is because, in recent years, available entry-level housing has been scarce to buyers. As a result, potential first-time homebuyers are electing to rent single-family homes, making Atlanta an excellent rental property investment market.

Rents in Atlanta have increased by 23% year over year show no signs of slowing. For example, investors might expect to pay $2,095 per month for a three-bedroom condo in Atlanta. The most expensive areas include Peachtree Center, South Tuxedo Park, and Buckhead Village Hills, with rents exceeding $5,000 per month.

ABOUT LISTABILITY

ListAbility provides quality lists

ListAbility has aligned with the nation’s most comprehensive and accurate data compilers. In brief, they have been collecting, analyzing and compiling data from numerous sources for 40 or more years. Indeed, our clients have benefited from the ability to optimize their marketing budget by targeting their best prospects. Unquestionably, the accuracy is top notch with monthly updates. Most of our mailing lists include the National Change of Address (NCOA)

Furthermore, we have joined forces with some newer compilers. While they might not have all the granularity and choices as our primary vendors, but they can include phone and email contact information in addition to the mailing address for your list.

Photo by Venti Views on Unsplash